The total change in the price of the futures contract since year-end is 10000. An entry to OCI is made to reduce the cash flow reserve by 7000 ie 95000 88000.

Fasb In Focus Accounting Standards Update No 2017 12 Derivatives Hedging Topic 815 Targeted Improvements To Accounting For Hedging Activities

Simple past tense and past participle of design.

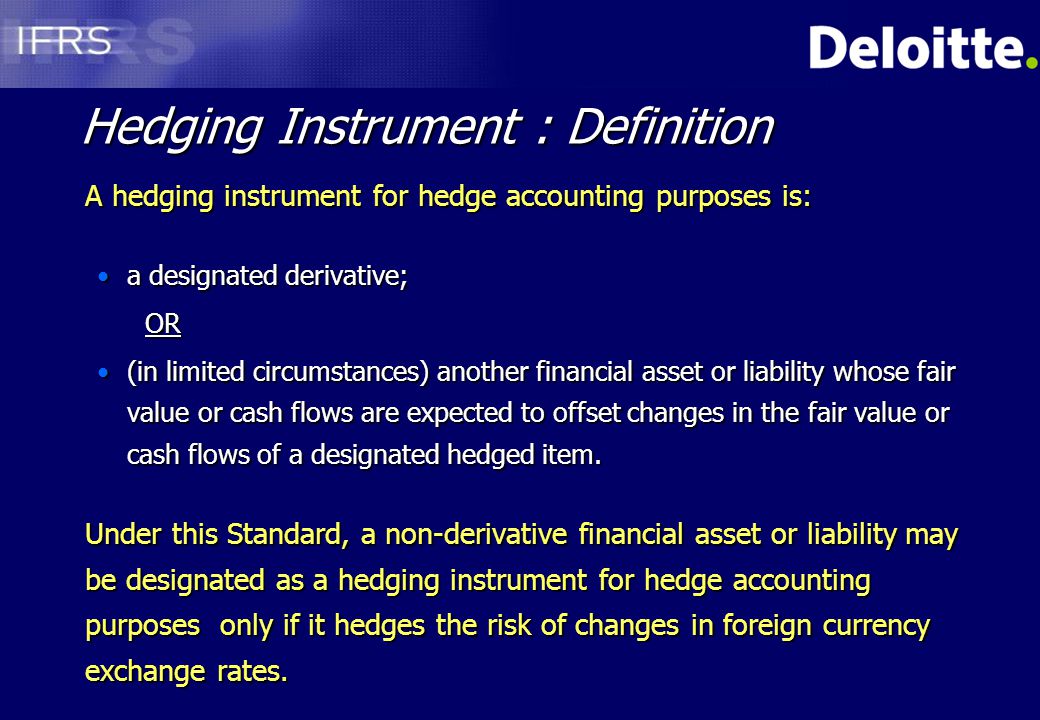

. If a component of the cash flows of a financial or a non-financial item is designated as the hedged item that component must be less than or equal to the total cash flows of the entire item. For financial entities the situation is more complex. Non-derivative financial instruments measured at fair value through PL 15 43.

Hedging with forward contracts 16 46. Therefore 3000 hedge ineffectiveness. What can be designated as hedging instruments.

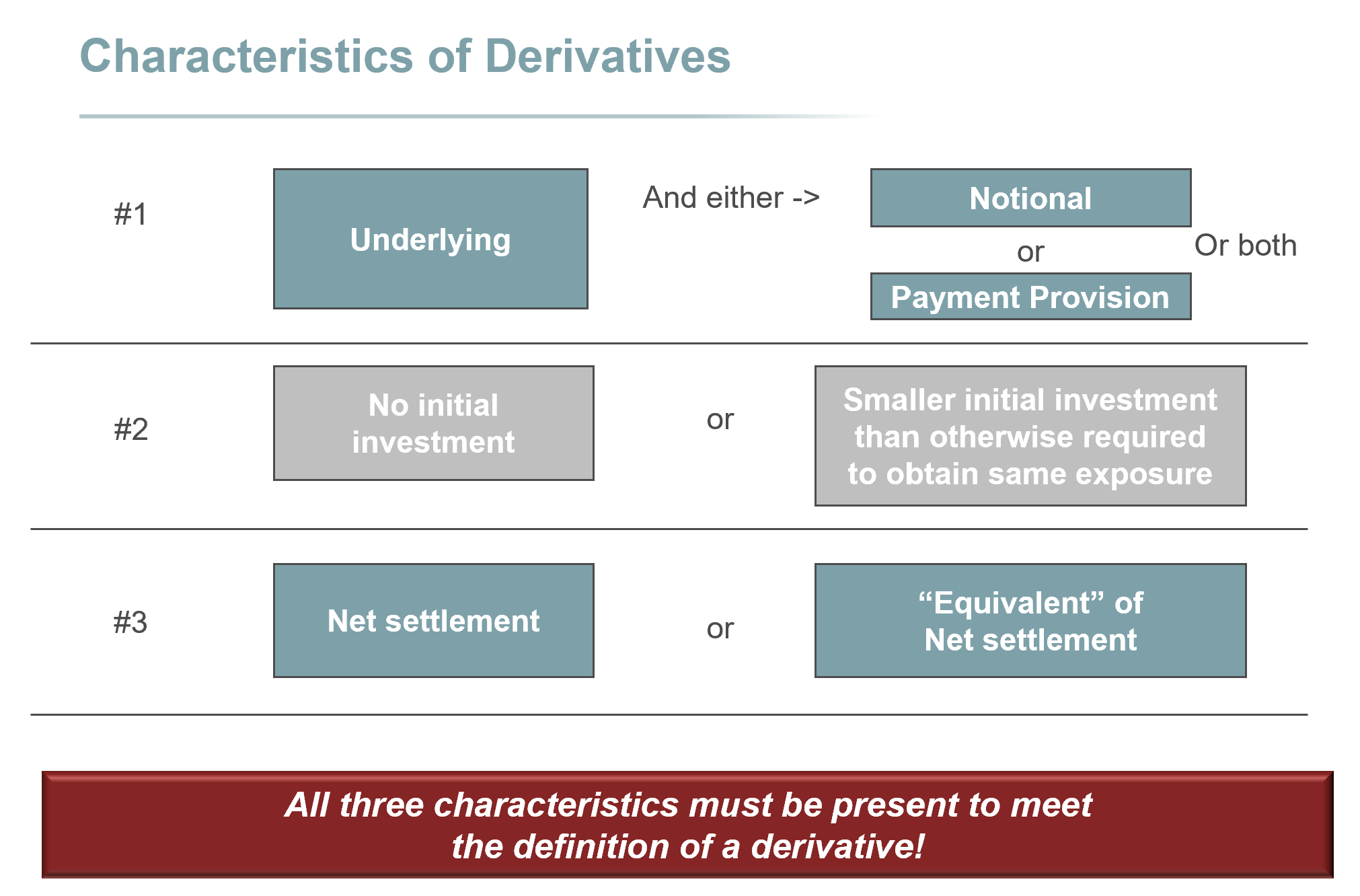

Embedded derivatives 15 44. Simple past tense and past participle of designate. 2 the availability of natural hedges that can be highly effective.

The proposed standard simplifies the accounting for hedging activities and generally increases the appeal of hedge accounting. Designated vs non designated hedge Purity encouraged nail art with white coronary heart shapes within the nail strategies easy nonetheless exquisiteShades of white and silver beads are preferred simply because they can certainly match your outfit regardless of what situation it may be. The Disclosure also explains the difference between a Designated Agency and a Non-Designated Agency.

A financial asset is subsequently measured at amortized cost if it is held within a business model whose objective is to hold the asset in order to collect contractual cash flows and the contractual terms of. This assessment encompasses operational aspects such as the hedge effectiveness test as well as the eligibility of items such as risk components of non-financial items that can be designated in hedging relationships. In reviewing the reports of a large sample of firms we find the following four explicit reasons why companies may decide not to designate derivatives as accounting hedges.

Hedge accounting has not been achi eved in the past. Designated Vs Non Designated Hedge. A fair value hedge may be designated for a firm commitment not recorded or foreign currency cash flows of a recognized asset or.

In fact hedge accounting is currently a leading cause of restatements and some companies refrain from using hedge accounting to avoid the cost and hassle of compliance. Created according to a design. 1 the substantial cost of documentation and ongoing monitoring of designated hedges.

Non-designated heritage assets in Conservation Areas. It concerned with borrowing in the foreign currency to match the cash flow patterns. This is a very important distinction to understand before you make the decision to become a Client of the Agent andor Agency.

17 Apr 2018 1 MINUTE READ. 2 What would be the difference if we apply hedge accounting and if we do not apply hedge accounting because I cant see a difference ie under hedge accounting the net amount between what we pay and what we receive will go to PL basically the non-effective portion. Hedge accounting is a method of accounting where entries to adjust the fair value of a security and its opposing hedge are treated as.

And ongoing monitoring of. If the company has a designated fair value hedge where the hedged item is taxed in line with its accounting treatment the tax treatment of the derivative is to simply. The ineffective part in profit or loss and The effective part in other comprehensive income as a cash flow hedge reserve.

Hedge is formed in order to lessen or eliminate economic exposure. But that could change now that the FASB has issued Accounting Standards Update ASU No. Designated Hedge Agreement means any Hedge Agreement other than a Commodities Hedge Agreement to which the Borrower or any of its Subsidiaries is a party and as to which a Lender or any of its Affiliates is a counterparty that pursuant to a written instrument signed by the Administrative Agent has been designated as a Designated Hedge Agreement so that the.

Designated Hedge Agreement means any Hedge Agreement other than a Commodity Hedge Device to which any Credit Party is a party and as to which a Lender or any of its affiliates is a counterparty that pursuant to a written instrument signed by Agent has been designated as a Designated Hedge Agreement so that such Credit Partys counterpartys credit exposure. Accounting for currency basis spreads 17 5. However all of the cash flows of the entire item may be designated.

Having a specified designation. Derivative financial instruments 15 42. Hedging with purchased options 15 45.

A cash flow hedge may be designated for a highly probable forecasted transaction a firm commitment not recorded on the balance sheet foreign currency cash flows of a recognized asset or liability or a forecasted intercompany transaction. We would like to show you a description here but the site wont allow us. Illustration assessing the hedge effectiveness vs.

2017-12 Derivatives and Hedging Topic 815 Targeted Improvements to. Measuring hedge ineffectiveness Imagine you assume to make a sale in 6 months in foreign currency and you want to protect yourself against the foreign currency risk. Under normal accounting we would still affect PL with the net amount.

The gain or loss on a derivative instrument not designated a hedging instrument appears in current income. January 15 202 To recognize the settlement of the futures contract hedging instrument. A Non-Designated Agency real estate firm owes a duty of loyalty to a client which is shared by all agents of the firm.

Designated Fair value hedge. IFRS 9 contains no restrictions regarding the circumstances in which a derivative can be designated as a hedging instrument provided the hedge accounting criteria are met except for some written options. A particular type of hedging transaction is having the objective of managing the foreign.

Detail hedge accounting is described under IAS 39- Financial Instruments. This is a hedge of the fair value of an asset or liability in a purchase sale transaction or firm commitment at a definite price. Non-derivative financial instruments measured at.

3 a new accounting standard that. A recent Court Judgment has brought some additional and important clarification on how non-designated heritage assets NDHAs in Conservation Areas should be dealt with in the context of planning decisions. Annual Report 2019-20 2102 Subsequent measurement a.

I Financial assets carried at amortized cost.

Hedge Accounting Lecture Notes 1 Principle Of Finance 2018 Studocu

Connolly International Financial Accounting And Reporting 4 Th Edition Chapter 25 Financial Instruments Ppt Download

Agenda Scope And Definitions Ias 32 Ias Ppt Download

Financial Instruments Recognition And Measurement Ias 39 Wiecek And Young Ifrs Primer Chapter Ppt Download

Fasb In Focus Accounting Standards Update No 2017 12 Derivatives Hedging Topic 815 Targeted Improvements To Accounting For Hedging Activities

0 comments

Post a Comment